Your 20s are a transformative time. You’re carving out your career, making big decisions, and figuring out how to live independently. But one of the most important things you can do for your future self is to start building strong financial habits now. It may seem overwhelming, but the truth is, it’s about small, consistent steps. Here’s how to level up your finances in your 20s with advice that’s both professional and practical — and even a little fun.

1. Set a Weekly List of Topics to Learn

One of the most powerful ways to gain control over your finances is to invest in your financial literacy. But, let’s face it — diving into the world of budgeting, investing, and saving can be a lot to absorb all at once. A smart way to tackle this is by dedicating a specific topic to each week. Start with basics like budgeting and gradually move to more complex areas such as investing or understanding credit scores.

Why it works: Setting a weekly learning goal helps break down overwhelming concepts into manageable bits. And the best part? You don’t have to be an expert to get started. Use free resources online, like blogs, YouTube videos, and financial apps, to stay on track. You’ll quickly find that your knowledge grows exponentially without feeling like you’re doing homework.

2. Make Time for Finance Videos Every Day

In today’s digital world, there’s no shortage of information available to us. The key is consuming it in a way that’s both educational and practical. Whether it’s watching a 10-minute YouTube video or catching a quick TikTok about personal finance, these bite-sized tips can make a big difference. Remember do not take advice from creators who have no financial background or are not truly successful themselves.

Why it works: Watching short, daily finance videos will keep you updated and help reinforce what you learn. You don’t need hours of study time to stay informed — a daily commitment to watching just one video a day can increase your financial confidence. Start small and gradually challenge yourself to dive into more complex topics as you progress.

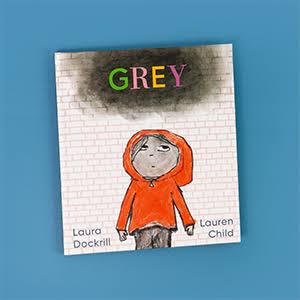

We recommend

3. Start Conversations About Money with Friends

The truth is, no one really talks about money openly, especially when you’re in your 20s. But here’s a secret: your friends are probably navigating the same financial challenges you are. Sharing financial insights and strategies with your circle can be incredibly valuable. Not only can you learn from their experiences, but it also helps create a supportive environment where you can hold each other accountable.

Why it works: Talking about money with friends opens up new perspectives and strengthens your financial decision-making. Discussing things like saving strategies, managing student debt, or investing can be empowering and encourage you to take action. Plus, you’ll likely discover they have some great tips you can apply to your own life.

4. Stay Updated with Economic News

Understanding the world around you and how economic events impact your personal finances is essential. Reading a daily economics column or staying updated with financial news helps you connect the dots between global events and your own financial decisions. For example, how does inflation affect your purchasing power? Or why should you care about the stock market? These are questions you’ll start to consider as you build a solid foundation.

Why it works: Staying informed about economic trends helps you anticipate changes that could affect your savings, investments, and spending habits. By reading reputable financial news sources, you’ll gain a clearer understanding of the world’s financial landscape and how it directly impacts your finances.

5. Listen to Money Podcasts for Continuous Learning

Money podcasts are a great way to learn on the go. Whether you’re commuting, working out, or even cooking dinner, listening to finance-related podcasts can give you the information you need in an easy-to-digest format. Some podcasts are tailored specifically for young adults in their 20s, so you’ll be able to hear advice that’s directly relevant to your current life stage.

Why it works: Podcasts make it easy to absorb financial knowledge while multitasking. Plus, they often feature real-life stories, interviews with successful people, and actionable tips you can start using today. The more you listen, the more you’ll feel like you’re sitting in a conversation with a mentor guiding you to financial freedom.

Final Thoughts:

Leveling up your finances in your 20s doesn’t need to be intimidating. By committing to a weekly learning goal, staying updated with bite-sized videos, engaging in financial conversations with friends, reading about economic trends, and listening to finance podcasts, you’ll start building the financial foundation you need for the future. The key is consistency — start small, stay consistent, and soon you’ll be the one offering financial advice to your friends. Your future self will thank you!